|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Chapter 7 Bankruptcy Liquidation: A Comprehensive Guide

Chapter 7 bankruptcy liquidation is a legal process designed to help individuals or businesses eliminate overwhelming debts. It is often referred to as 'straight bankruptcy' and involves the sale of a debtor's non-exempt assets by a trustee. The funds from the sale are then distributed to creditors to settle debts.

What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy is a form of liquidation that allows debtors to discharge unsecured debts such as credit card balances and medical bills. Unlike other bankruptcy chapters, Chapter 7 does not involve a repayment plan.

Eligibility Criteria

To qualify for Chapter 7 bankruptcy, an individual must pass a means test, which compares their income to the median income of their state. If the income is below the median, they may be eligible for Chapter 7.

Exempt vs. Non-Exempt Assets

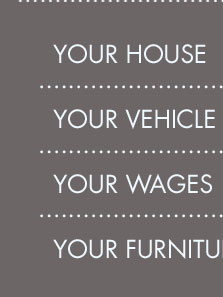

During the Chapter 7 process, debtors can keep exempt assets, such as necessary clothing and household items, while non-exempt assets are liquidated to pay off debts.

The Bankruptcy Process

The Chapter 7 bankruptcy process typically involves several key steps:

- Filing the Petition: Debtors must file a petition with the bankruptcy court to initiate the process.

- Automatic Stay: Once filed, an automatic stay is granted, preventing creditors from pursuing collections.

- Trustee Appointment: A trustee is appointed to manage the debtor's estate and oversee the liquidation of assets.

- Meeting of Creditors: Debtors must attend a meeting with creditors, where the trustee and creditors can ask questions.

- Discharge of Debts: Upon completion, eligible debts are discharged, releasing the debtor from personal liability.

It's crucial to consult with a bankruptcy attorney la mesa ca for guidance throughout this complex process.

Advantages and Disadvantages

Understanding the benefits and drawbacks of Chapter 7 bankruptcy can help individuals make informed decisions.

Advantages

- Complete debt relief for unsecured debts.

- Fast process, typically completed within a few months.

- Protection from creditors through the automatic stay.

Disadvantages

- Potential loss of non-exempt assets.

- Negative impact on credit score.

- Public record of bankruptcy filing.

For those considering this option, discussing the specifics with a bankruptcy attorney lawrence ks can provide clarity on personal circumstances.

FAQs

What debts are discharged in Chapter 7 bankruptcy?

In Chapter 7 bankruptcy, most unsecured debts like credit card balances, medical bills, and personal loans are discharged. However, certain debts such as student loans, child support, and tax obligations are typically not dischargeable.

How long does Chapter 7 bankruptcy remain on a credit report?

Chapter 7 bankruptcy can remain on a credit report for up to ten years from the filing date. However, its impact on credit diminishes over time, especially with responsible financial behavior post-bankruptcy.

This section is derived from section 2a(5) of the Bankruptcy Act [section 11(a)(5) of former title 11]. It permits the court to authorize the operation of any ...

Chapter 7 bankruptcy is a liquidation proceeding. The assets of a debtor that are not exempt from creditors are collected and liquidated (reduced to money),

11 U.S. Code Chapter 7 - LIQUIDATION - SUBCHAPTER IOFFICERS AND ADMINISTRATION ( 701 707) - SUBCHAPTER IICOLLECTION, LIQUIDATION, AND DISTRIBUTION OF THE ...

![]()